AI-Driven Credit Score Monitoring and Improvement for Fintech Leader

Summary

AltF2's Pathfinder platform empowered a leading fintech company to streamline credit score monitoring and improvement with a comprehensive AI-driven Credit Score Monitoring and Improvement dashboard.

Introduction

In today's competitive financial market, maintaining a healthy credit score is crucial for both businesses and individuals. A high credit score grants access to favorable loan terms, lower interest rates, and better insurance premiums. However, manually monitoring credit reports and taking proactive steps towards improvement can be a time-consuming and complex task.

A leading fintech company, a valued client of AltF2, approached us to automate their credit score monitoring and improvement processes. They sought a solution that would leverage the power of AI to provide their customers with real-time credit score insights and personalized recommendations for improvement.

Challenge

The client's existing credit score monitoring system was a manual process, relying on customers to actively check their reports for errors or discrepancies. This reactive approach made it difficult to identify and address issues promptly. Additionally, they lacked a system to provide customers with actionable steps to improve their credit scores.

- Inefficient credit report monitoring: Manual review of credit reports was time-consuming and prone to human error.

- Limited visibility into credit score factors: Customers lacked a clear understanding of the factors impacting their credit scores.

- Absence of personalized improvement strategies: The client couldn't provide customers with tailored recommendations to improve their creditworthiness.

Solution

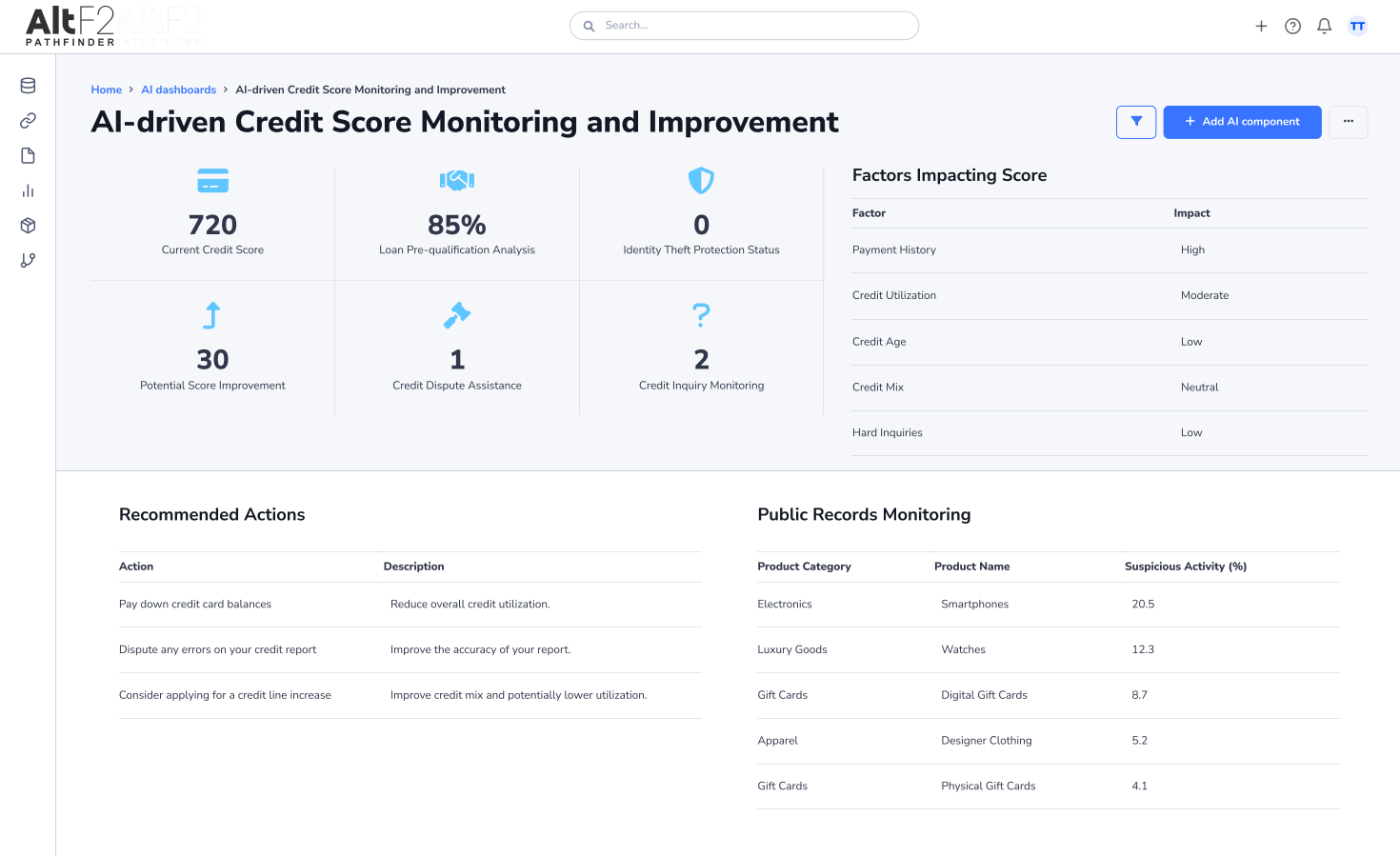

AltF2's Pathfinder platform provided the client with a customizable AI-driven Credit Score Monitoring and Improvement dashboard (see screenshot below). This innovative dashboard offered a centralized platform to streamline credit score monitoring and empower customers to take control of their financial health.

Dashboard Details

The AI-driven Credit Score Monitoring and Improvement dashboard features the following key components:

- Current Credit Score (KPI): A prominent display of the customer's current credit score with a clear indication of whether it falls within the "good," "fair," or "poor" range.

- Loan Pre-qualification Analysis (KPI): An analysis that indicates the customer's likelihood of loan approval based on their current credit score.

- Identity Theft Protection Status (KPI): Real-time monitoring for signs of identity theft that could negatively impact credit scores.

- Potential Score Improvement (KPI): An estimate of the potential credit score improvement achievable within a specific timeframe.

- Credit Dispute Assistance: A guided tool to assist customers in disputing errors or inaccuracies on their credit reports.

- Credit Inquiry Monitoring: Alerts for new credit inquiries that could potentially lower credit scores.

- Factors Impacting Score (Table): A detailed breakdown of the various factors affecting the customer's credit score, along with their weightage and improvement suggestions.

- Recommended Actions (Table): Personalized recommendations for actions customers can take to improve their credit score, such as paying down credit card debt, reducing credit utilization, or obtaining a secured credit card.

- Public Records Monitoring (Table): Monitoring of public records for any negative events that could impact credit scores (e.g., bankruptcies, foreclosures).

- Credit Card Recommendation (Table): Based on the customer's credit profile, recommendations for credit cards that offer rewards programs or favorable interest rates.

- Credit Score Trend (Line Chart): A visual representation of the customer's credit score over time, allowing them to track progress and measure the effectiveness of improvement efforts.

Conclusion & Results

By leveraging AltF2's Pathfinder platform with the AI-driven Credit Score Monitoring and Improvement dashboard, the client achieved significant improvements in customer satisfaction and credit health.

- Enhanced customer experience: The automated dashboard provided customers with real-time credit score insights and personalized recommendations, empowering them to take charge of their financial well-being.

- Improved credit score outcomes: Customers were able to identify and address credit score issues promptly, leading to measurable improvements in their overall creditworthiness.

- Increased customer retention: By providing valuable credit score management tools, the client fostered stronger relationships with their customers and boosted customer retention rates.

Testimonial

"AltF2's Pathfinder platform has been instrumental in revolutionizing our approach to credit score monitoring. The AI-driven Credit Score Monitoring and Improvement dashboard has empowered our customers to take control of their credit health and achieve significant improvements. We are confident that this solution will continue to play a vital role in our customer success strategy."