AI-Driven Strategic Portfolio Management for Asset Management Firms

Summary

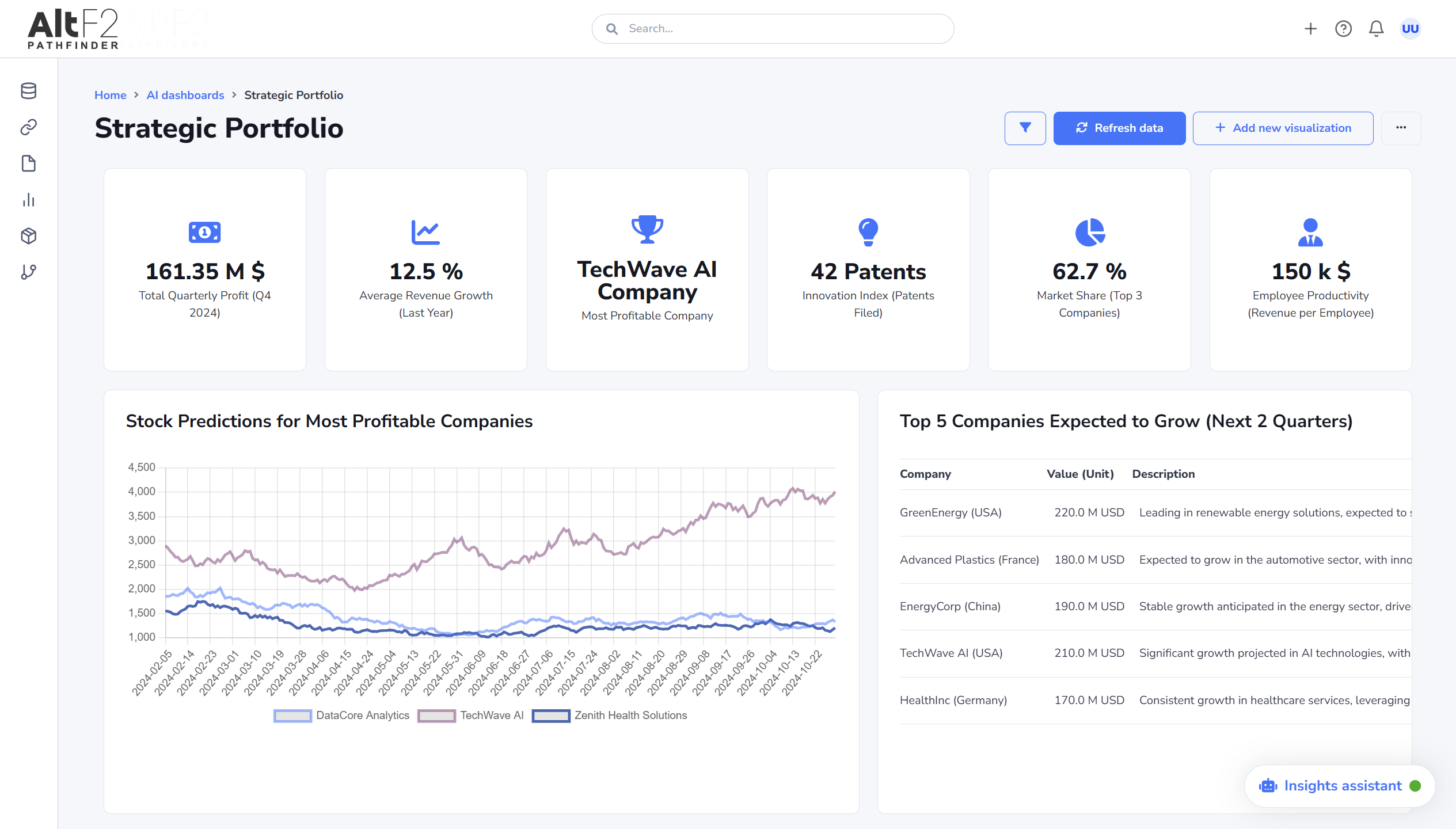

AltF2's Pathfinder platform empowers asset management firms with an AI-driven strategic portfolio dashboard, providing meaningful insights into investment performance and market trends to enhance decision-making and forecasting capabilities.

Introduction

In the dynamic world of asset management, firms need to navigate vast amounts of investment and market data to make informed decisions. Traditional methods can be inefficient and may not provide the depth of insights required to stay ahead. AltF2's Pathfinder offers a cutting-edge solution to these challenges.

Pathfinder's AI-driven strategic portfolio dashboard enables asset management firms to gain access to trends and factors that influence the potential profit of current and future investments, enhancing their ability to meet reporting and forecasting expectations of customers and shareholders.

Challenge

Fund managers face several challenges in managing their investment portfolios:

- Data Overload: The sheer volume of investment and market data can be overwhelming, making it difficult to extract meaningful insights.

- Inefficient Reporting: Traditional reporting methods may not provide real-time insights, leading to delayed decision-making.

- Inaccurate Forecasting: Without advanced analytics, forecasting can be prone to errors, affecting investment strategies.

- Lack of Predictive Analytics: Traditional tools may lack predictive capabilities to anticipate market trends and investment performance.

Solution

Pathfinder's AI-driven strategic portfolio dashboard addresses these challenges by leveraging advanced analytics and machine learning.

Dashboard Details

The strategic portfolio dashboard provides a comprehensive overview with key metrics and predictive insights:

- Total Quarterly Profit (Q4 2024): Displays the total profit across all companies in the portfolio, amounting to $161.35 million USD, providing a clear picture of overall financial performance.

- Average Revenue Growth (Last Year): Shows an average growth of 12.5%, indicating positive trends across the portfolio companies.

- Most Profitable Company: Highlights TechWave AI Company as the leading profit generator, focusing attention on high-performing assets.

- Innovation Index (Patents Filed): Reflects the portfolio's innovation through 42 patents filed, showcasing the commitment to R&D and future growth potential.

- Market Share (Top 3 Companies): Indicates that the top three companies hold a 62.7% market share, emphasizing the strength and dominance of key investments.

- Employee Productivity (Revenue per Employee): Measures efficiency with a revenue of $150,000 USD per employee, informing operational strategies.

- Stock Predictions for Most Profitable Companies: A line graph predicting stock performance for DataCore Analytics, TechWave AI, and Zenith Health Solutions, aiding in future investment decisions.

- Top 5 Companies Expected to Grow (Next 2 Quarters): A table providing projections and growth drivers for companies like GreenEnergy, Advanced Plastics, EnergyCorp, TechWave AI, and HealthInc, guiding investment focus.

Conclusion & Results

By utilizing Pathfinder's AI-driven strategic portfolio dashboard, asset management firms can achieve significant advantages:

- Enhanced Decision-Making: Access to real-time, meaningful insights supports informed investment strategies.

- Improved Forecasting: Machine learning services like sentiment and feature analysis enhance forecasting accuracy.

- Operational Efficiency: Automation of data analysis reduces manual efforts, allowing fund managers to focus on strategic initiatives.

- Competitive Edge: Predictive analytics and trend identification enable firms to stay ahead in the market.

Testimonial

"Pathfinder has revolutionized our investment analysis process. The strategic portfolio dashboard provides us with actionable insights and predictive analytics that have significantly improved our reporting and forecasting capabilities."