AI-powered Financial Product Recommendation Engine: Empowering Informed Investment Decisions

Summary

AltF2's Pathfinder platform empowers a FinTech company to leverage AI-driven insights for a personalized financial product recommendation engine, enhancing customer experience and conversion rates.

Introduction

In today's dynamic financial landscape, providing personalized investment recommendations is crucial for FinTech companies to stay ahead of the curve. However, manually analyzing vast amounts of customer data and market trends to offer suitable products can be a time-consuming and resource-intensive task.

This use case illustrates how AltF2's Pathfinder platform empowered a FinTech company to develop an AI-powered financial product recommendation engine, delivering a superior customer experience and boosting conversion rates.

Challenge

The FinTech company faced several challenges in their existing recommendation system:

- Limited Data Insights: Manually analyzing vast datasets to identify customer preferences and market trends was inefficient.

- Generic Recommendations: One-size-fits-all recommendations failed to cater to individual customer financial goals and risk tolerance.

- Reliance on Financial Advisors: Customers heavily relied on financial advisors, leading to scalability limitations.

- Inaccurate Risk Assessment: Traditional methods struggled to accurately assess customer risk tolerance.

Solution

By implementing AltF2's Pathfinder platform, the FinTech company was able to develop a sophisticated AI-powered financial product recommendation engine.

Dashboard Details

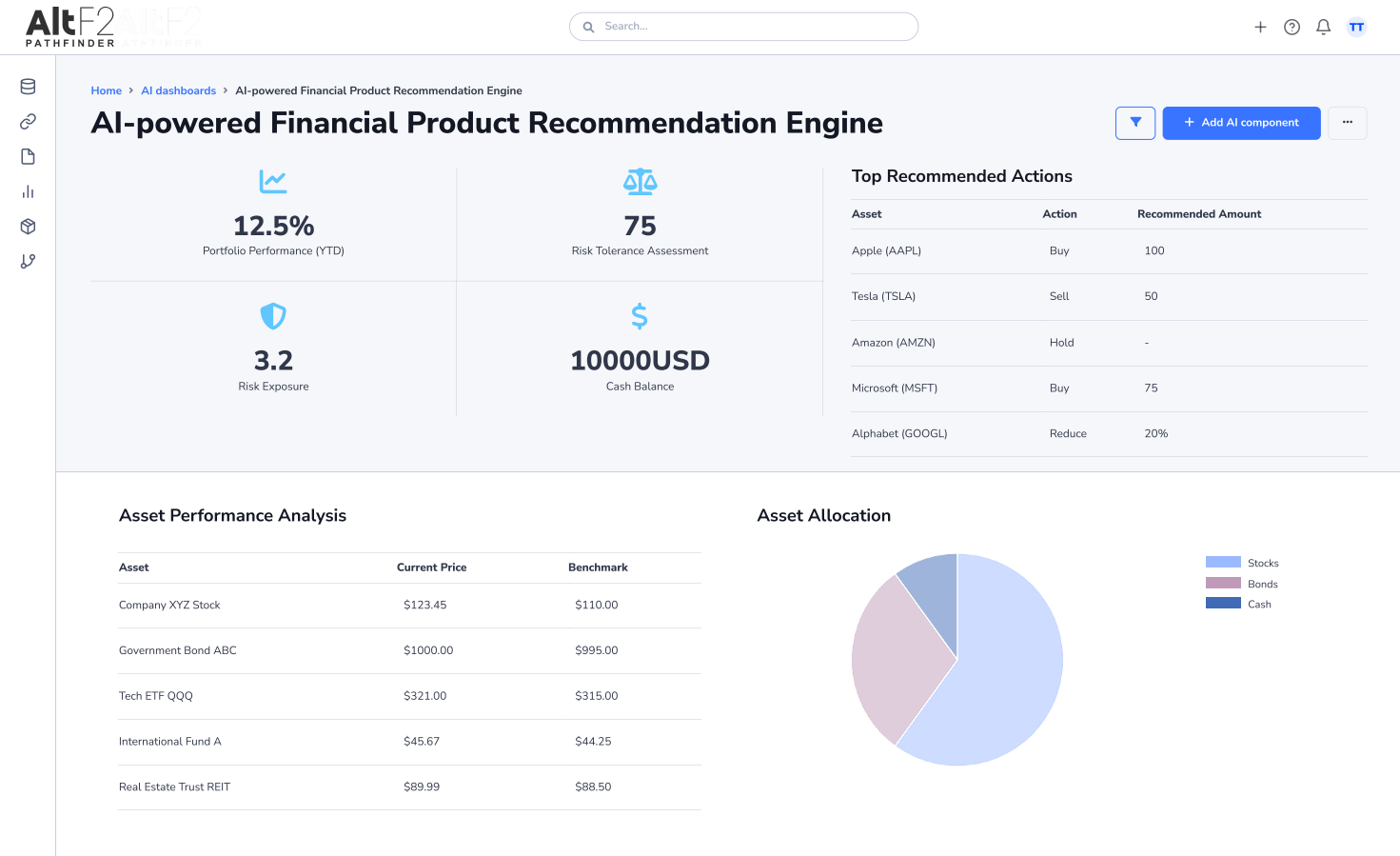

Pathfinder's AI-powered dashboard provided a comprehensive view of customer financial health and risk tolerance. Key features included:

- Portfolio Performance (YTD): Track overall portfolio performance and identify areas for improvement.

- Asset Allocation (Pie Chart): Visualize asset diversification and identify potential imbalances.

- Risk Exposure (Kpi): Gain insights into a customer's current risk tolerance level.

- Cash Balance (Kpi): Monitor readily available cash for potential investment opportunities.

- Top Recommended Actions (Table): Receive tailored recommendations based on individual financial goals and risk tolerance.

- Asset Performance Analysis (Table): Analyze the performance of individual assets within the portfolio.

- Risk Tolerance Assessment (Kpi): Get a data-driven assessment of a customer's risk tolerance for informed decision-making.

- Suggested Investment Products (Table): Explore a curated list of investment products aligned with customer profiles.

- Market News & Analysis (Table): Stay informed about relevant market trends and news impacting investment decisions.

Conclusion & Results

By leveraging AltF2's Pathfinder platform, the FinTech company achieved significant improvements:

- Enhanced Customer Experience: Personalized recommendations led to a more engaging and satisfying customer experience.

- Increased Conversion Rates: Data-driven insights improved the accuracy and relevance of recommendations, leading to higher conversion rates.

- Improved Scalability: Automating the recommendation process reduced reliance on financial advisors, enabling the FinTech company to serve a wider customer base.

- Data-Driven Risk Management: AI-powered risk assessment ensured customers were matched with suitable investment products based on their risk tolerance.

Testimonial

"AltF2's Pathfinder platform has been instrumental in transforming our financial product recommendation process. By leveraging AI, we can now provide our customers with personalized and data-driven recommendations, leading to a significant improvement in customer satisfaction and conversion rates."