AI-Powered Personalized Budgeting for Fintech Companies

Summary

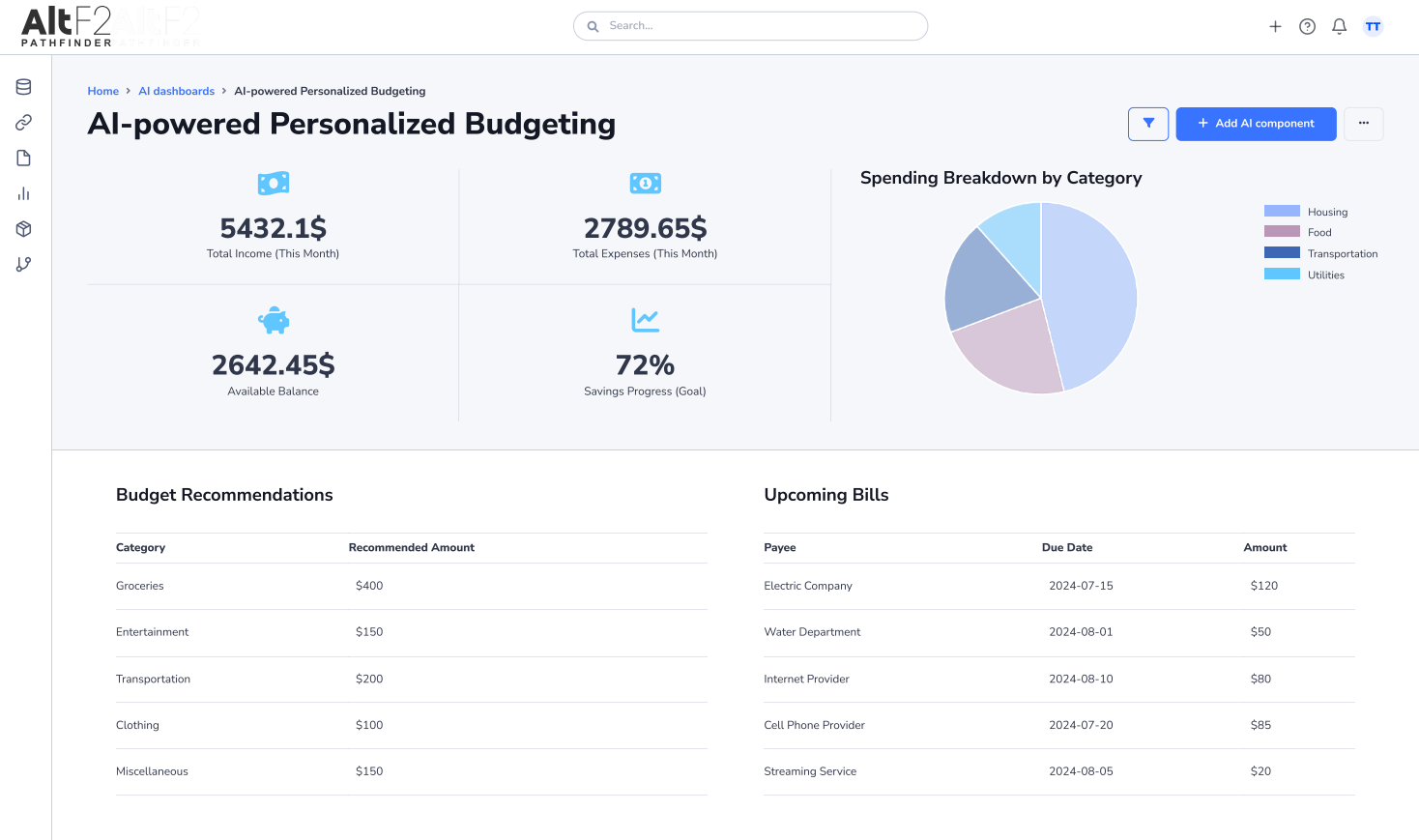

AltF2's Pathfinder platform empowers fintech companies to deliver a superior customer experience with AI-powered personalized budgeting dashboards.

Introduction

Customer satisfaction is paramount in the competitive fintech industry. Delivering personalized financial tools that empower users is crucial for building trust and loyalty. But with vast amounts of customer data, it can be challenging to create insightful and actionable financial management experiences.

This is where AltF2's Pathfinder platform comes in. By leveraging AI and machine learning, Pathfinder helps fintech companies create intelligent dashboards that provide users with a holistic view of their finances, personalized budgeting tools, and actionable insights to achieve their financial goals.

Challenge

A leading fintech company approached AltF2 with the following challenges:

- Limited financial literacy: Many users lacked a deep understanding of their finances, making it difficult to manage their budgets effectively.

- Generic budgeting tools: The company's existing budgeting tools were one-size-fits-all, failing to cater to individual financial needs and goals.

- Data overload: Users were overwhelmed by the amount of financial data presented to them, hindering their ability to make informed decisions.

- Lack of engagement: Basic budgeting tools failed to capture user interest, leading to low adoption rates.

Solution

AltF2 implemented the Pathfinder platform and developed a custom AI-powered Personalized Budgeting dashboard. This dashboard addressed the client's challenges by providing the following features

Dashboard Details

The AI-powered Personalized Budgeting dashboard offered users a comprehensive view of their finances, including:

- Total Income (This Month) (Kpi): A clear overview of the user's monthly income.

- Total Expenses (This Month) (Kpi): Real-time insights into the user's spending habits.

- Available Balance (Kpi): Up-to-date information on the user's spending power.

- Savings Progress (Goal) (Kpi): Visualization of the user's progress towards their savings goals.

- Spending Breakdown by Category (Pie Chart): Clear identification of spending areas, allowing for better budget allocation.

- Budget Recommendations (Table): Personalized suggestions based on the user's income, expenses, and savings goals.

- Upcoming Bills (Table): Reminders for upcoming bills to ensure timely payments and avoid late fees.

- Savings Goal Settings (Pie Chart): Ability to set and track progress towards different savings goals.

- Financial Resources (Table): Links to helpful financial resources and educational materials.

Conclusion & Results

The implementation of the AI-powered Personalized Budgeting dashboard led to significant improvements for the fintech company, including:

- Increased user engagement with financial management tools.

- Improved financial literacy among users.

- Better budgeting habits and informed financial decision-making.

- Higher customer satisfaction and loyalty.

Testimonial

"AltF2's Pathfinder platform has been a game-changer for our company. The AI-powered Personalized Budgeting dashboard has empowered our users to take control of their finances and achieve their financial goals. We've seen a significant increase in user engagement and satisfaction, and we're confident that this will translate to long-term customer loyalty."