Intelligent Transaction Categorization for FinTech Businesses

Summary

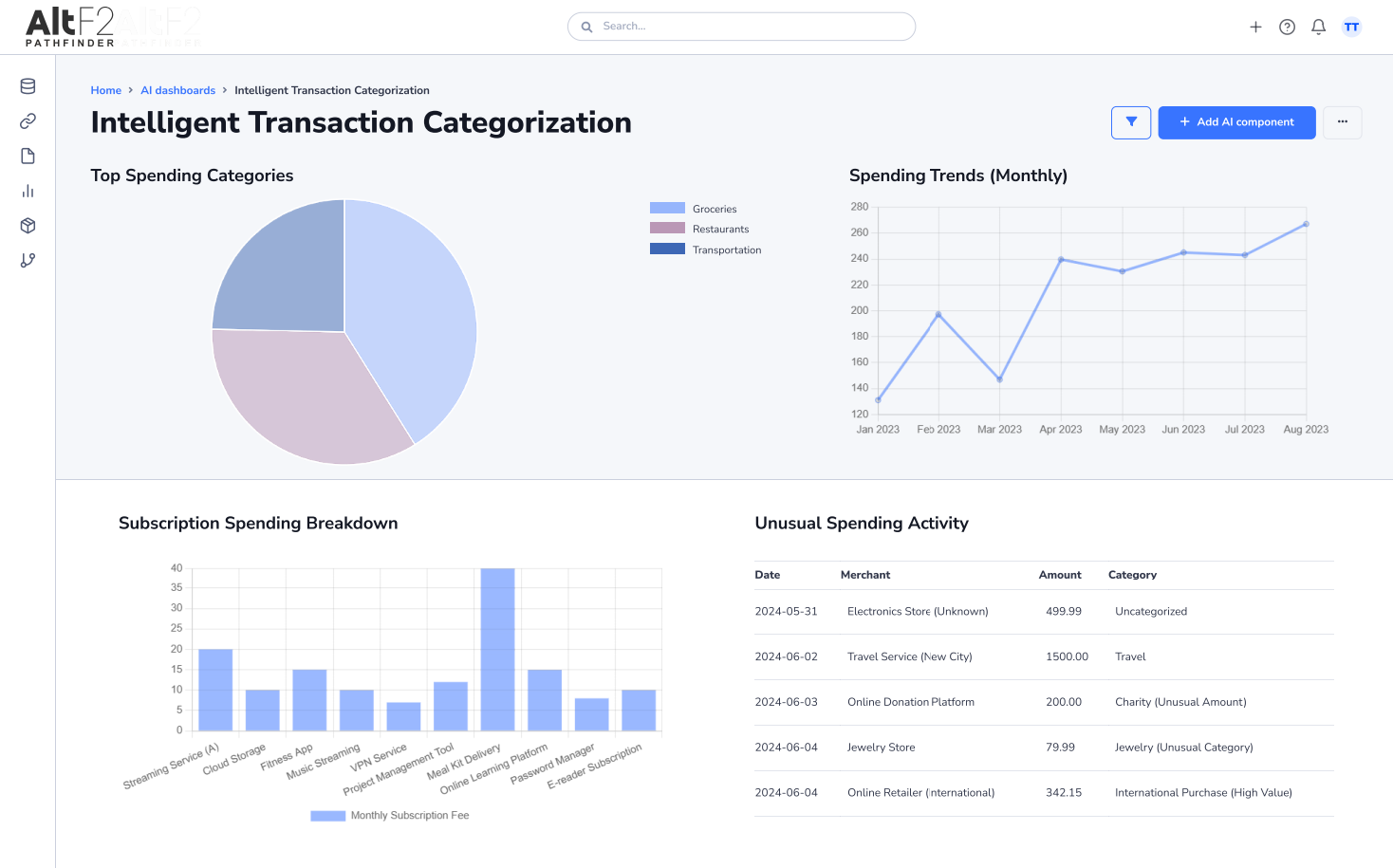

AltF2's Pathfinder helped a FinTech company gain control of their financial data with an AI-powered dashboard that automatically categorizes transactions, identifies spending trends, and uncovers unusual activity.

Introduction

For FinTech companies, accurate transaction categorization is crucial. It empowers them to understand their customer's financial behavior, personalize financial products, and identify potential fraud. However, manually categorizing transactions can be a time-consuming and error-prone process.

This use case explores how AltF2's Pathfinder helped a FinTech business overcome the challenge of transaction categorization and gain valuable insights into their customer's spending habits.

Challenge

The FinTech company faced several challenges with manual transaction categorization:

- Inaccuracy: Manually assigning categories to transactions was prone to human error, leading to inaccurate data.

- Inefficiency: The manual process was slow and resource-intensive, diverting resources from core business activities.

- Lack of Insights: Inconsistent categorization made it difficult to identify spending trends and customer financial behavior.

- Fraud Detection Challenges: Inaccurate categorization hampered fraud detection efforts.

Solution

AltF2's Pathfinder implemented an Intelligent Transaction Categorization dashboard to automate the process and provide valuable financial insights.

Dashboard Details

The Intelligent Transaction Categorization dashboard offered the following features:

- Top Spending Categories (Pie Chart): This chart visualized the breakdown of spending across different categories.

- Spending Trends (Monthly) (Line Chart): This chart tracked spending patterns over time, identifying seasonal fluctuations or unusual spending spikes.

- Subscription Spending Breakdown (Bar Chart): This chart provided insights into recurring subscription spending, helping customers manage their financial commitments.

- Unusual Spending Activity (Table): This table flagged potentially fraudulent or unusual transactions for further investigation.

- Recent Transactions (This Week) (Table): This table displayed recent transactions, allowing for quick review and categorization verification.

- Miscategorized Transactions (Table): This table identified transactions that were not automatically categorized, enabling manual intervention and improvement of the AI model's accuracy over time.

Conclusion & Results

Pathfinder's Intelligent Transaction Categorization dashboard empowered the FinTech company with:

- Improved Accuracy: Automatic categorization minimized human error and ensured data consistency.

- Increased Efficiency: Automating categorization freed up resources for core business activities.

- Actionable Insights: Categorized data enabled the identification of spending trends and customer financial behavior, leading to better product development and customer service.

- Enhanced Fraud Detection: Automatic flagging of unusual transactions improved fraud detection capabilities.

Testimonial

"AltF2's Pathfinder has been a game-changer for our business. The Intelligent Transaction Categorization dashboard has saved us significant time and resources while providing us with valuable customer insights that we can leverage to improve our products and services."