Predictive Financial Risk Management for Fintech Leader

Summary

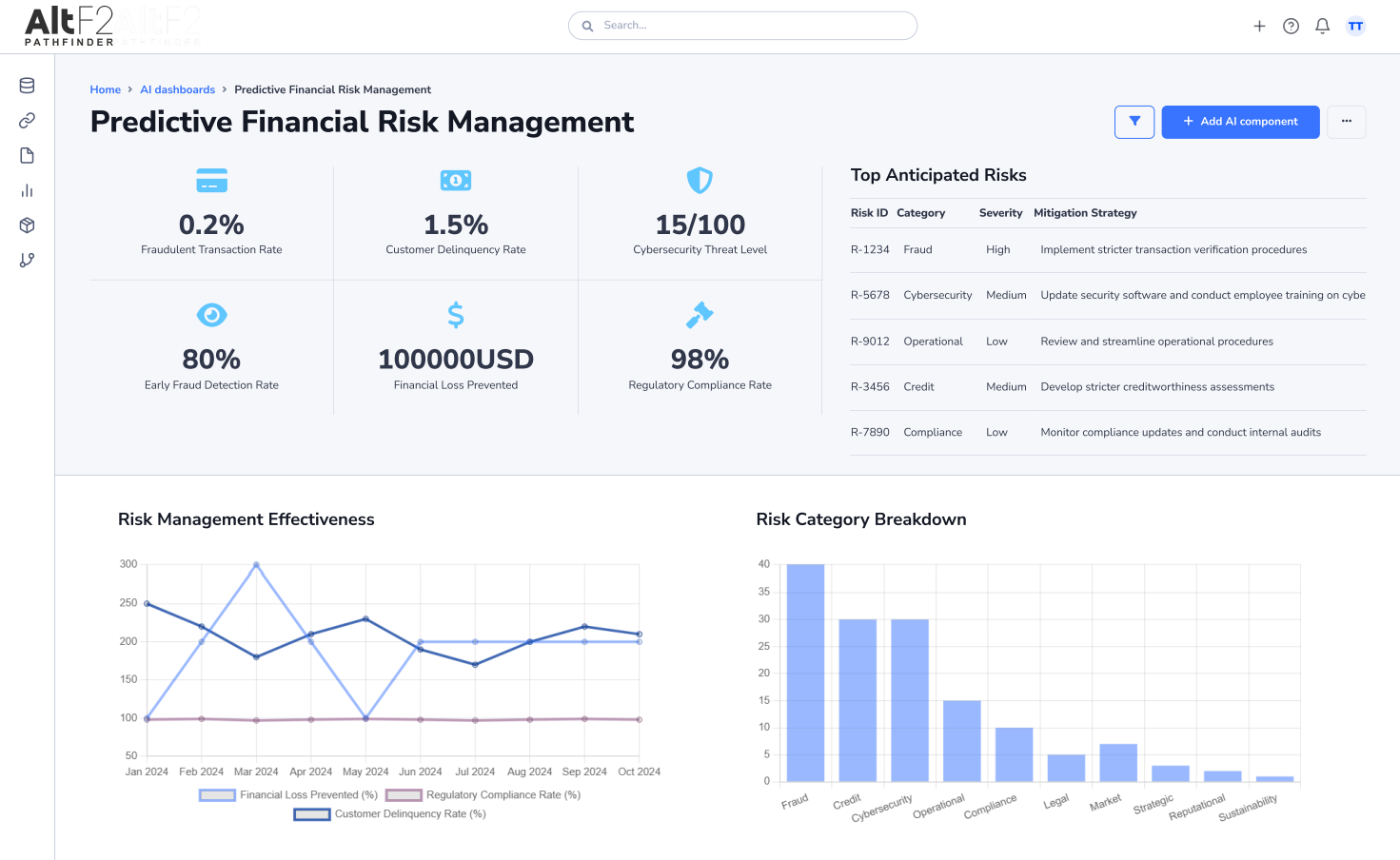

AltF2's Pathfinder platform empowered a leading fintech company to proactively manage financial risk with a comprehensive Predictive Financial Risk Management dashboard.

Introduction

In today's dynamic financial landscape, fintech companies face a multitude of financial risks, including fraudulent transactions, customer delinquency, and cybersecurity threats. These risks can not only erode profits but also damage customer trust and regulatory standing.

One of AltF2's valued clients, a leading fintech company, approached us with the challenge of proactively identifying and mitigating financial risks. They desired a data-driven solution that would empower them to make informed decisions and safeguard their financial future.

Challenge

The client relied on manual processes and disparate data sources to monitor financial risk. This fragmented approach made it difficult to gain real-time insights and proactively identify emerging threats. They lacked a centralized platform to:

- Visualize key risk indicators (KPIs): Fraudulent transaction rates, customer delinquency rates, and cybersecurity threat levels.

- Quantify the effectiveness of risk management strategies: Measure the impact of implemented controls on preventing financial losses.

- Identify top anticipated risks: Gain insights into potential threats based on historical data and industry trends.

- Gain a comprehensive view of risk distribution: Understand how risk is distributed across different transaction types and customer segments.

Solution

AltF2's Pathfinder platform provided the client with a customizable Predictive Financial Risk Management dashboard (see screenshot below). This powerful dashboard offered a holistic view of their financial risk landscape, empowering them to make data-driven decisions and mitigate potential losses.

Dashboard Details

The Predictive Financial Risk Management dashboard features the following key components:

- KPIs: Visualization of critical financial risk indicators, including fraudulent transaction rate, customer delinquency rate, cybersecurity threat level, early fraud detection rate, financial loss prevented, and regulatory compliance rate.

- Top Anticipated Risks: A table highlighting the most likely risks to occur based on historical data and industry trends.

- Risk Management Effectiveness: A line chart that tracks the effectiveness of implemented risk management strategies in preventing financial losses over time.

- Risk Category Breakdown: A bar chart that visually depicts the distribution of risk across different categories (e.g., transaction type, customer segment).

- Transaction Risk Distribution: A pie chart that showcases the proportion of transactions categorized under different risk levels.

- Emerging Risk Trends: A table identifying new and evolving risk factors that require close monitoring.

Conclusion & Results

By leveraging AltF2's Pathfinder platform, the client gained a comprehensive understanding of their financial risk landscape. The Predictive Financial Risk Management dashboard provided real-time insights that enabled them to:

- Proactively identify and mitigate potential threats: Early detection of fraudulent transactions and customer delinquency led to significant cost savings.

- Optimize risk management strategies: Data-driven insights allowed for targeted interventions and resource allocation, improving the overall effectiveness of risk mitigation efforts.

- Maintain regulatory compliance: Real-time monitoring of key metrics ensured adherence to evolving financial regulations.

Testimonial

"AltF2's Pathfinder platform has been a game-changer for our risk management strategy. The Predictive Financial Risk Management dashboard provides us with invaluable insights that empower us to proactively identify and mitigate financial risks. We are confident that this solution will contribute significantly to our long-term financial success."