Rule-Based Tagging & Scoring

We implement geographic, industry, and client-profile risk tiers (Low/Medium/High), compliance flags for PEPs, sanctions, and internal watchlists, and operational markers such as dormant accounts and transaction recency—all configured through intuitive rule screens.

LLM-Powered Context Extraction

Our solution provides sentiment analysis, next-action recommendations, and summary tags via large language models, complete with custom prompt engineering and human-in-loop validation for accuracy.

Third-Party Data Augmentation

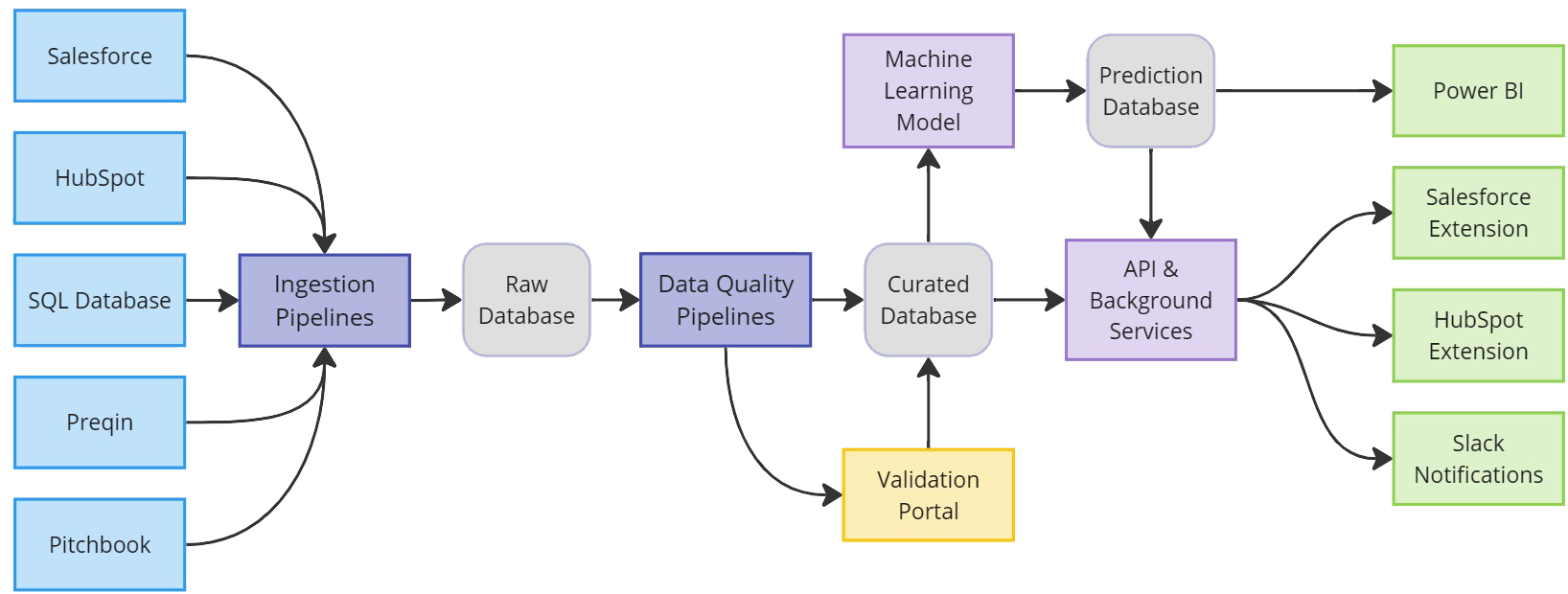

Integrations with market intelligence providers such as Preqin, PitchBook, Bloomberg, and Refinitiv deliver deep profiling, while flexible connectors ensure seamless enrichment without disrupting existing pipelines.

Seamless ETL Integration

Enrichment steps are embedded directly in your ETL pipeline with configuration screens for mapping, threshold settings, and refresh schedules—no separate jobs or scripts required.