Feature Engineering & Data Transformation

Derive metrics such as growth rates and engagement signals to spotlight key drivers, and prioritize inputs to maximize model precision and interpretability.

Model Selection & Parameter Tuning

Evaluate algorithms—logistic regression, decision trees, random forests, gradient boosting—and optimize hyperparameters for balanced accuracy and explainability.

Performance Evaluation & Explainability

Validate against historical data (Accuracy, AUC-ROC, F1, RMSE, R²) and provide clear factor-importance insights using SHAP or similar tools.

Scheduled Retraining & Monitoring

Implement semi-annual retraining cycles to adapt to market or data shifts, with automated drift detection to trigger model refreshes seamlessly.

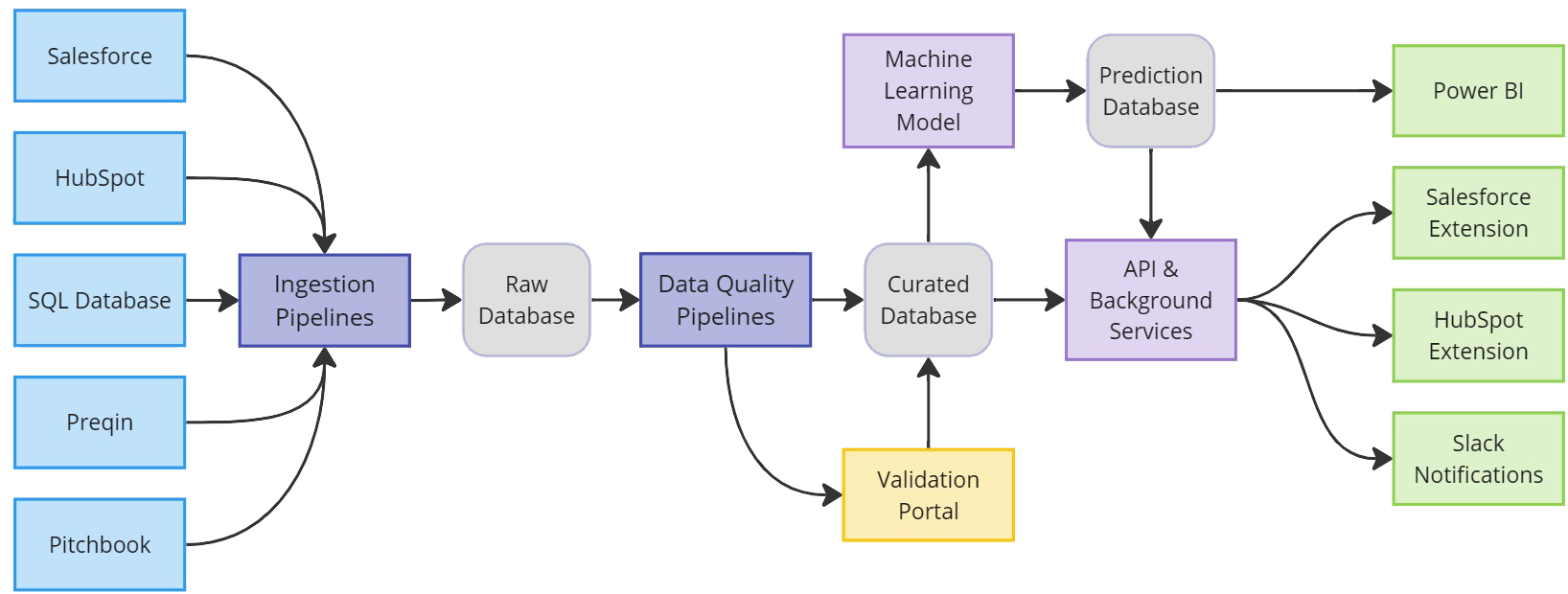

Seamless Integration

Expose real-time API endpoints for on-demand predictions and background processing services for batch scoring, persisting outputs in your database for downstream use.

Model Types

Traditional ML handles classification, regression, risk scoring and cross-sell detection; Deep Learning tackles time-series forecasting, anomaly detection and sentiment/text analysis.